Your Guide to Reliable Hard Money Lenders Atlanta, Georgia

Wiki Article

Discover Just How Hard Money Lenders Can Help You Safeguard Quick Financing

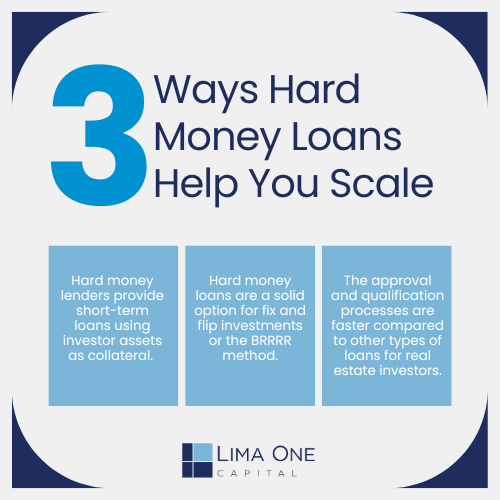

In the world of safeguarding financing for various endeavors, the function of hard money loan providers has actually gained significant grip as a result of their capability to offer quick accessibility to resources when typical methods may drop brief. These loan providers supply an one-of-a-kind recommendation in the economic landscape, characterized by a streamlined authorization procedure and more versatile loaning standards compared to traditional financial institutions. For companies or people looking for expedited financing services, recognizing how hard cash loan providers run and the advantages they offer the table can confirm to be an important advantage in navigating the often complicated surface of safeguarding funds successfully and promptly.Benefits of Hard Cash Lenders

Hard cash lenders offer expedited funding remedies with fewer governmental hurdles contrasted to conventional lending organizations. In scenarios where time is of the significance, such as in actual estate purchases or when confiscating a time-sensitive financial investment opportunity, difficult money lending institutions can give the required funds rapidly, typically within a matter of days (hard money lenders atlanta).In addition, hard cash lenders are more adaptable in their loaning requirements contrasted to financial institutions and various other standard banks. They are primarily worried about the value of the security being used to secure the funding, as opposed to the debtor's credit report or earnings. This makes difficult cash fundings an attractive alternative for debtors who may not get typical financing as a result of past debt concerns or non-traditional incomes.

Quick Authorization Refine

With a structured application procedure and reliable assessment techniques, tough cash loan providers facilitate fast authorizations for debtors seeking expedited funding solutions. Unlike typical banks that may take weeks to process a loan application, hard cash loan providers can supply approval in a matter of days. Their concentrate on the collateral as opposed to the borrower's credit report enables a much faster decision-making process.To ensure a speedy authorization, consumers must prepare crucial records such as residential property information, proof of income, and a clear departure strategy. When the application is sent, difficult money lending institutions swiftly assess the residential property's worth and marketability to figure out the financing quantity and terms. This expedited process is specifically helpful for real estate capitalists looking to protect funds swiftly for time-sensitive opportunities.

Flexible Financing Standard

When evaluating possible debtors, difficult cash lenders use flexible financing standards customized to the certain needs and circumstances of each individual or entity. This tailored approach collections difficult cash loan providers apart from typical banks that typically have inflexible financing requirements. Tough cash loan providers understand that each customer is distinct, and consequently, they take into consideration elements past just credit report and income confirmation. By examining the collateral, building worth, and the debtor's total financial circumstance, tough cash lending institutions can offer more individualized loaning services.

Fast Accessibility to Resources

Supplying quick access to funds is a vital advantage of working with tough cash loan providers. Unlike standard banks, tough cash loan providers focus on effectiveness in their financing processes, making it possible for customers to access the capital they require promptly. This rate is especially useful for genuine estate financiers and tiny organization proprietors that frequently need instant funds to take lucrative chances or address urgent financial requirements.

Protecting Quick Funding

Offered the structured approval treatments and emphasis on collateral value by difficult cash loan providers, protecting fast funding ends up being a feasible service for borrowers in demand of prompt funds. By leveraging the value of the debtor's assets, such as genuine estate buildings or other beneficial recommended you read properties, difficult cash lending institutions can speed up the funding approval process.Unlike typical financial institutions that may take weeks or even months to accept a loan, tough money loan providers can often provide financing anchor within days. Overall, the capacity of difficult money lenders to promote swift funding services emphasizes their value in conference urgent funding demands.

Final Thought

In verdict, tough money lenders provide benefits such as quick approval processes, adaptable lending requirements, and quick access to funding. Safeguarding fast financing via these loan providers can be a feasible choice for people seeking quickly funding for their investments or jobs. The advantages of hard money providing make it an important resource for those in requirement of rapid monetary aid.In the realm of securing financing for various ventures, the duty of difficult cash loan providers has actually obtained considerable grip due to their ability to give quick access to capital additional resources when typical methods may fall short.With a streamlined application process and effective examination techniques, tough money lending institutions facilitate fast approvals for borrowers looking for expedited financing remedies.Additionally, flexible lending criteria enable difficult cash loan providers to function with customers who might not fulfill the stringent requirements of conventional loan providers. The capacity to adapt their financing standards based on the particular circumstances of each consumer allows hard cash lenders to provide efficient and quick funding options that satisfy the requirements of a varied array of clients.

Offered the structured authorization treatments and focus on collateral value by difficult money loan providers, safeguarding fast financing ends up being a viable option for customers in need of immediate funds. - hard money lenders atlanta

Report this wiki page